Revenue up 35% Year over Year

Ambarella, Inc. (NASDAQ: AMBA), a leading developer of low-power, HD video compression and image processing semiconductors, today announced financial results for its fiscal second quarter ended July 31, 2013.

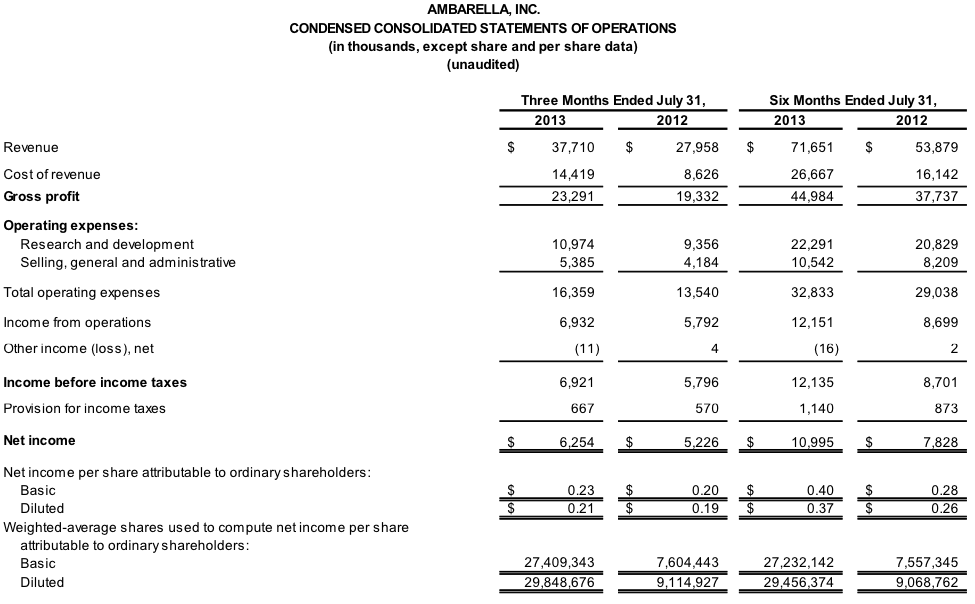

Revenue for the second quarter of fiscal 2014 was $37.7 million, up 35% from $28.0 million in the same period in fiscal 2013. For the six months ended July 31, 2013, revenue was $71.7 million, up 33% from $53.9 million for the six months ended July 31, 2012.

Gross margin under U.S. generally accepted accounting principles (GAAP) for the second quarter of fiscal 2014 was 61.8%, compared with 69.1% for the same period in fiscal 2013. For the six months ended July 31, 2013, GAAP gross margin was 62.8%, compared with 70.0% for the six months ended July 31, 2012.

GAAP net income for the second quarter of fiscal 2014 was $6.3 million, or $0.21 per diluted ordinary share, compared with GAAP net income of $5.2 million, or $0.19 per diluted ordinary share, for the same period in fiscal 2013. GAAP net income for the six months ended July 31, 2013 was $11.0 million, or $0.37 per diluted ordinary share. This compares with GAAP net income of $7.8 million, or $0.26 per diluted ordinary share, for the six months ended July 31, 2012.

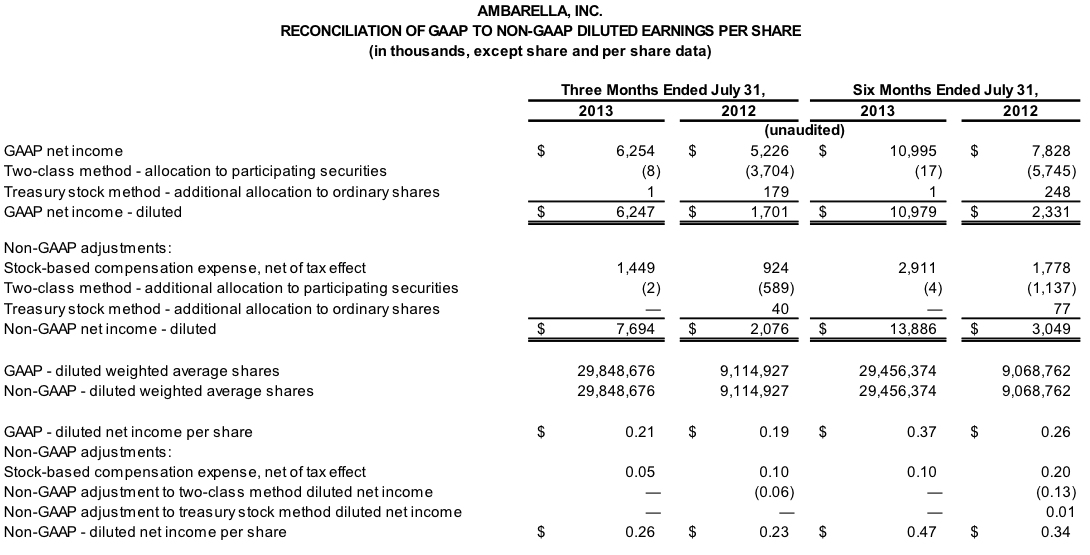

Gross margin on a non-GAAP basis for the second quarter of fiscal 2014 was 61.9%, compared with 69.2% for the same period in fiscal 2013. For the six months ended July 31, 2013, non-GAAP gross margin was 62.9%, compared with 70.1% for the six months ended July 31, 2012.

Non-GAAP net income for the second quarter of fiscal 2014 was $7.7 million, or $0.26 per diluted ordinary share. This compares with non-GAAP net income of $6.2 million, or $0.23 per diluted ordinary share for the same period in fiscal 2013. Non-GAAP net income for the six months ended July 31, 2013 was $13.9 million, or $0.47 per diluted ordinary share. This compares with non-GAAP net income of $9.6 million for the six months ended July 31, 2012, or $0.34 per diluted ordinary share.

Ambarella reports gross margin, net income and earnings per share in accordance with GAAP and, additionally, on a non-GAAP basis. Non-GAAP financial information excludes stock-based compensation expense and the associated tax impact. A reconciliation of the GAAP to non-GAAP gross margin, net income and earnings per share numbers, as well as a description of the items excluded from the non-GAAP calculations, is included in the financial statements portion of this press release.

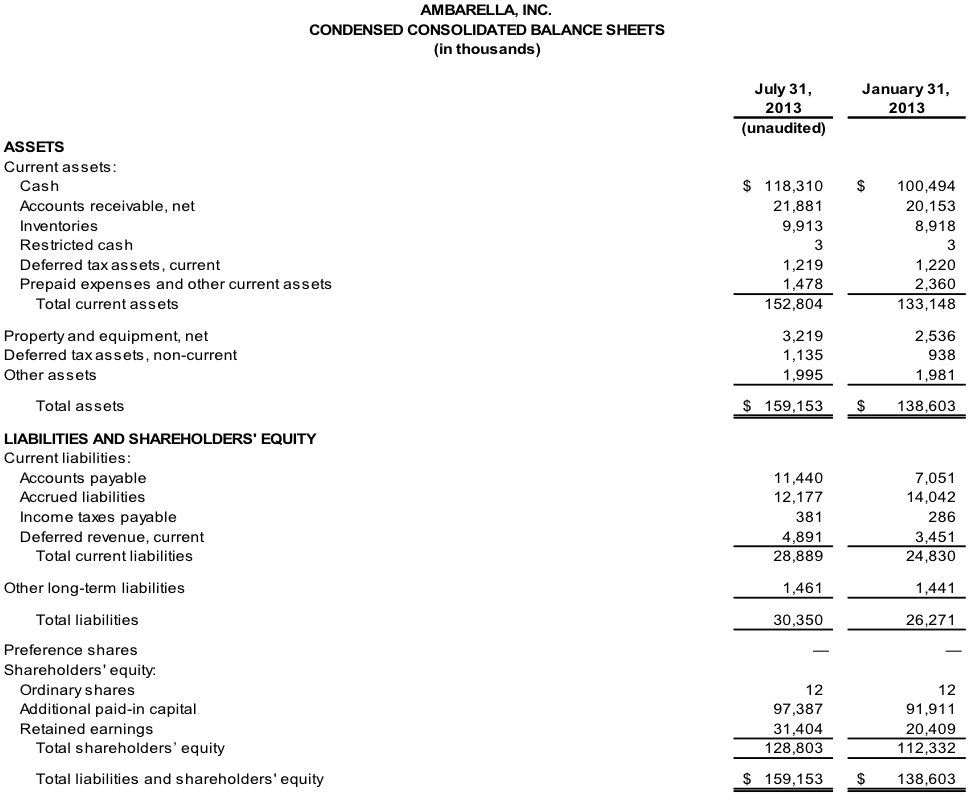

Cash and cash equivalents at the end of the second fiscal quarter of 2014 were $118.3 million, compared with $104.3 million at the end of the immediately preceding quarter and $65.2 million at the end of the same quarter a year ago.

“We continue to be very pleased with our progress, with second quarter revenue of $37.7 million, up 35% over the $28 million we reported in the same period a year ago,” said Fermi Wang, President and CEO of Ambarella. “We continue to enjoy solid success in professional and consumer IP security markets, where we are delivering cost effective, feature rich solutions for technically demanding products. In addition to our security market success, our wearable sports and automotive camera markets continue to grow, contributing to our strong year-over-year growth.”

Quarterly Conference Call

Ambarella plans to hold a conference call at 5 p.m. Eastern Time / 2 p.m. Pacific Time today with Fermi Wang, Chief Executive Officer, and George Laplante, Chief Financial Officer, to discuss second quarter fiscal 2014 results. The call can be accessed by dialing 877-304-8963 in the USA; international callers should dial 760-666-4834, participant passcode: 33440884. Please dial in ten minutes prior to the scheduled conference call time. A live and archived webcast of the call will be available on Ambarella’s website at https://www.ambarella.com/ for up to 30 days after the call.

About Ambarella

Ambarella, Inc. (NASDAQ: AMBA), is a leading developer of low-power, high-definition (HD) video compression and image processing solutions. The company’s products are used in a variety of HD cameras including security IP-cameras, wearable sports cameras, and automotive video camera recorders. Ambarella technology is also used in television broadcasting with TV programs being transmitted worldwide using Ambarella compression chips. For more information about Ambarella, please visit www.ambarella.com.

“Safe harbor” statement under the Private Securities Litigation Reform Act of 1995

This press release contains forward-looking statements that are not historical facts and often can be identified by terms such as “outlook,” “projected,” “intends,” “will,” “estimates,” “anticipates,” “expects,” “believes,” “could,” or similar expressions, including the comments of our CEO relating to expansion of our target markets and the ability of our technology and product features to gain market acceptance and design wins. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. Our actual results could differ materially from those predicted or implied, and reported results should not be considered as an indication of our future performance.

The success of our business is subject to risks and uncertainties that include, but are not limited to, risks associated with revenue being generated from new customers or design wins, neither of which is assured; our growth strategy; our ability to anticipate future market demands and future needs of our customers; our plans for future products; our ability to retain and expand customer relationships and to achieve design wins; our ability to successfully enter new markets; anticipated trends and challenges, including competition, in the markets in which we operate; our ability to effectively manage growth; our ability to retain key employees; and the potential for intellectual property disputes or other litigation.

Further information on these and other factors that could affect our financial results is included in the company’s Annual Report on Form 10-K, which is on file with the Securities and Exchange Commission. Additional information will also be set forth in the company’s quarterly reports on Form 10-Q, future annual reports on Form 10-K and other filings the company makes with the Securities and Exchange Commission from time to time, copies of which may be obtained by visiting the Investor Relations portion of our web site at www.ambarella.com or the SEC’s web site at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. The results we report in our Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2013 could differ from the preliminary results announced in this press release.

Ambarella assumes no obligation and does not intend to update the information contained in this press release, except as required by law.

Non-GAAP Financial Measures

The company has provided in this release non-GAAP financial information including non-GAAP gross margin, net income, and earnings per share, as a supplement to the condensed consolidated financial statements, which are prepared in accordance with generally accepted accounting principles (“GAAP”). Management uses these non-GAAP financial measures internally in analyzing the company’s financial results to assess operational performance and liquidity. The company believes that both management and investors benefit from referring to these non-GAAP financial measures in assessing its performance and when planning, forecasting and analyzing future periods. Further, the company believes these non-GAAP financial measures are useful to investors because they allow for greater transparency with respect to key financial metrics that the company uses in making operating decisions and because the company believes that investors and analysts use them to help assess the health of its business and for comparison to other companies. Non-GAAP results are presented for supplemental informational purposes only for understanding the company’s operating results. The non-GAAP information should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from non-GAAP measures used by other companies.

The company has provided below reconciliations between its non-GAAP financial measures to its most directly comparable GAAP financial measures.

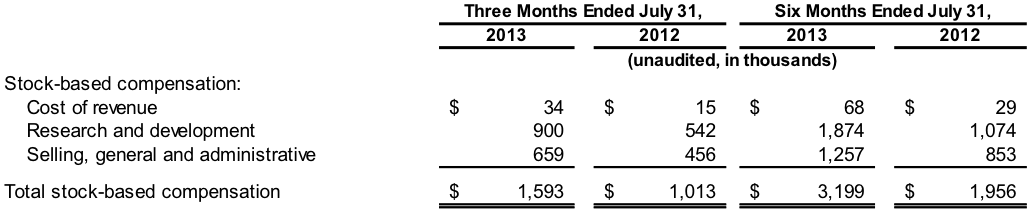

The following table presents details of stock-based compensation expense included in each functional line item in the consolidated statements of operations above:

The difference between GAAP and non-GAAP gross margin was 0.1% for each period. The difference was due to the effect of stock-based compensation, as disclosed in the table above, and the associated tax impact recorded for GAAP purposes.

Contact:

Deborah Stapleton, T: +1 650 470 4200, deb@stapleton.com